To outpace today’s fast-evolving fraud threats, financial institutions and merchants need one fundamental component: data. Effective fraud prevention and customer trust depend on it. As Entersekt’s Chief Product Officer, Pradheep Sampath, recently told PYMNTS:

“The thread that binds us all together is data that’s actionable, shared in good faith, and governed responsibly.”

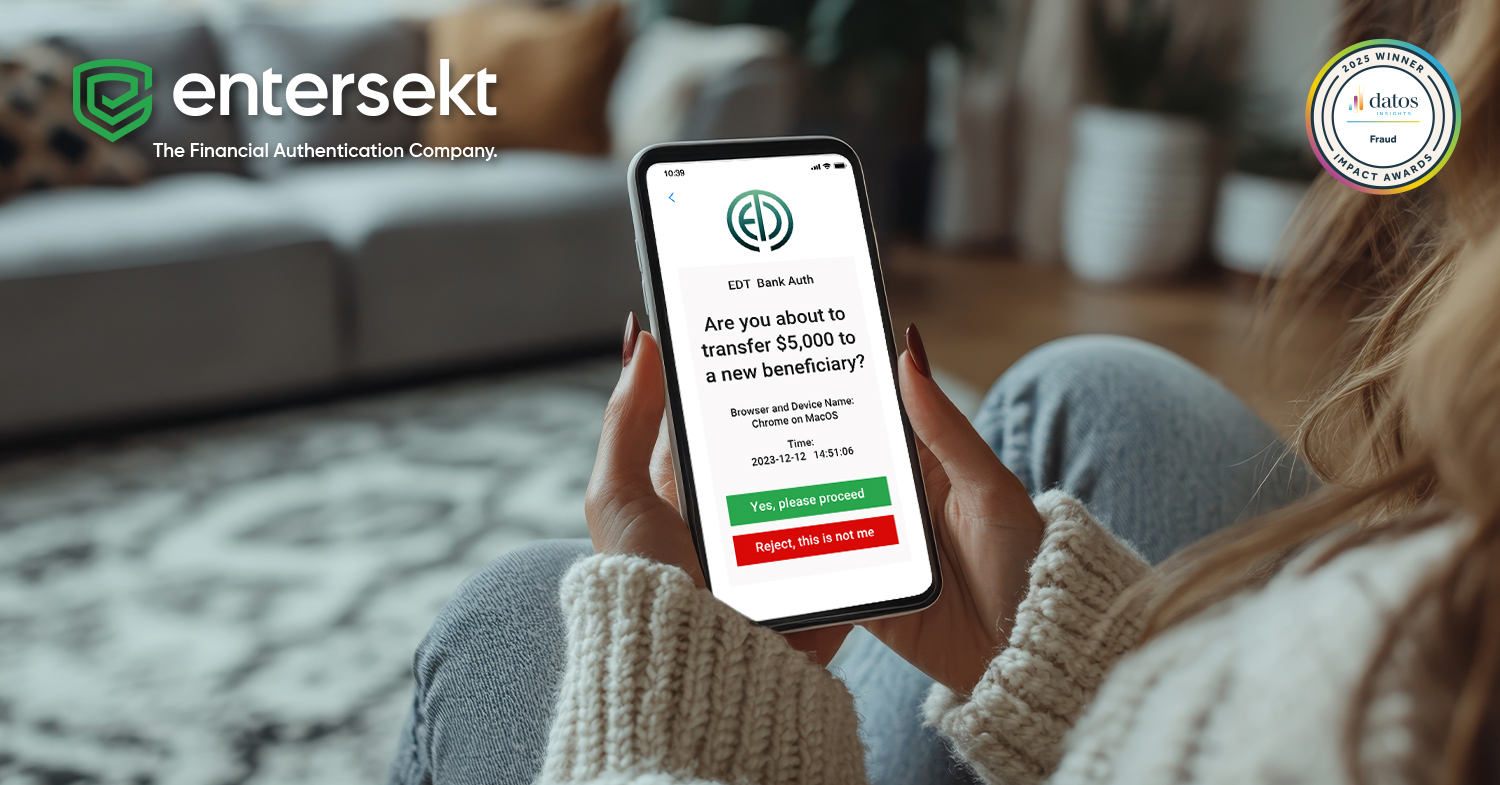

Real-time data is the fuel of modern, award-winning customer authentication. Entersekt — recognized as an industry leader in fraud and scam prevention, including Best Authentication Innovation in the Datos Insights 2025 Impact Awards — helps banks stay ahead with adaptive fraud defenses powered by data-driven intelligence.

The growing sophistication of fraud in digital banking and payments

Fraud is no longer an arms race financial institutions (FIs) can afford to lose. According to Juniper Research, fraud is expected to rise by 153% globally by 2030, costing over $58 billion. Unfortunately, AI tools like large language models (LLMs) and generative AI, have given fraudsters a technological edge. This advanced technology enables everything from deepfake voice cloning to synthetic identities, often forming the building blocks of sophisticated social engineering scams.

Related blog: Learn more about why FIs need AI in the fight against growing AI fraud here.

As Datos Insights affirms in their 2025 Impact Awards in Fraud report, banks need a different class of defenses to keep pace with AI-driven fraud. Fraud defenses that leverage a broad range of real-time signals, are best suited to safeguard customers while ensuring a seamless customer experience.

The danger of relying on traditional authentication methods

Consumers are connected pretty much 24/7 in today’s always-on digital lifestyle. And that means, the more they interact, the greater the risk of their personal or sensitive information landing in the wrong hands. As a result, traditional fraud prevention measures that rely on static authentication, like one-time passcodes (OTPs), stand little chance against modern fraud and scam vectors. These outdated security measures are easily intercepted by fraudsters.

The fraud cat and mouse game, where fraudsters continually find a way around the latest safeguard, is not new and unlikely to ever be fully eradicated. To prevent phishing attacks, for instance, the industry ramped up single-factor authentication to two-factor, but fraudsters found a way around that too.

This ‘leapfrogging’ dynamic confirms that OTPs and other static authentication measures are no match for adaptive threats, like today’s AI-enhanced social engineering attacks. At this stage in the game, fraudsters are even able to manipulate customers into playing an active part in their scams, tricking them into authorizing payments to fraudulent accounts.

FIs and merchants that stick with outdated authentication tools risk not only higher fraud losses but irreparable erosion of customer trust. The solution lies in collecting data signals and sharing that intelligence across an institution’s channels.

The fraud cat and mouse game, where fraudsters continually find a way around the latest safeguard, is not new and unlikely to ever be fully eradicated. To prevent phishing attacks, for instance, the industry ramped up single-factor authentication to two-factor, but fraudsters found a way around that too.

This ‘leapfrogging’ dynamic confirms that OTPs and other static authentication measures are no match for adaptive threats, like today’s AI-enhanced social engineering attacks. At this stage in the game, fraudsters are even able to manipulate customers into playing an active part in their scams, tricking them into authorizing payments to fraudulent accounts.

FIs and merchants that stick with outdated authentication tools risk not only higher fraud losses but irreparable erosion of customer trust. The solution lies in collecting data signals and sharing that intelligence across an institution’s channels.

Integrating cross-channel risk intelligence for a unified fraud defense

Without data, FIs are flying blind. They need data to distinguish fraudsters from legitimate customers. The Datos Insights award report highlights Entersekt’s real-time, data-rich approach. By collecting data across multiple customer touchpoints, such as login, transactions and other digital activities, modern authentication like Entersekt’s can quickly identify suspicious patterns and behaviors. This vital intelligence, however, must not be left trapped in siloes.

As the report explains, fragmented fraud defenses are a critical industry weakness. Many banks operate with siloed systems that leave exploitable blind spots. Traditional risk-based solutions, which typically do operate in silos, miss the opportunity to share risk intelligence across an institution’s banking and payment channels.

As the report explains, fragmented fraud defenses are a critical industry weakness. Many banks operate with siloed systems that leave exploitable blind spots. Traditional risk-based solutions, which typically do operate in silos, miss the opportunity to share risk intelligence across an institution’s banking and payment channels.

Entersekt’s cross-channel data integration solves this by unifying customer and risk data across every channel. This creates a holistic view of interactions, enabling FIs to spot and stop fraud, building resilience against emerging threats.

Futureproofing your bank with data-driven, award-winning authentication

Fraud is evolving faster than traditional defenses. In their report, Datos Insights confirms what the industry already sees: only authentication powered by real-time, data-driven intelligence can deliver true fraud resilience. In addition, that data, when shared across the banking and payment ecosystem, can help everyone fighting the fraud battle build a stronger wall, faster.

Futureproofing authentication means leveraging real-time fraud intelligence, recognizing emerging risks early — before they escalate — and designing solutions that adapt and evolve with those threats. By partnering with Entersekt, organizations can shift from reactive to proactive fraud prevention, a competitive differentiator for maintaining and growing trust.

Download our ebook to dive deeper:

Futureproofing authentication means leveraging real-time fraud intelligence, recognizing emerging risks early — before they escalate — and designing solutions that adapt and evolve with those threats. By partnering with Entersekt, organizations can shift from reactive to proactive fraud prevention, a competitive differentiator for maintaining and growing trust.

Download our ebook to dive deeper: