With payments revenue predicted to exceed $3 trillion by 2027, instant payment technology, like FedNow, will likely move up the priority list for many FIs.

FedNow, the Federal Reserve’s new instant payment infrastructure, was launched in July 2023, and aims to provide efficient and safe instant payment services across the US. For many customers and small businesses that rely on receiving payments promptly, FedNow and other instant payment solutions, provide:

- Faster payments

- Lower costs per transaction

- Greater financial transparency

- Easier cash flow management

The shift from traditional check payments — which can take days to process — to faster, more convenient payment procedures is a big step towards more modern online banking. But the added convenience doesn’t come without added risk.

Instant payments vs online payment fraud

Innovation in banking technology is often a two-edged sword. While the advances improve the level of convenience for banking customers, it also introduces new opportunities for fraudsters. FedNow payment fraud is already on the rise as well as authorized push payment fraud, leveraging real-time payment technology.

With instant payments, fraudsters now have instant access to big bucks, fast. In fact, BAI explains the core danger with FedNow’s instant payments as, “...the ability to move up to $500,000 in a single transaction,” and that “the stakes are high.” As a result, FIs need tools to detect and prevent fraud even faster, since instant payments are also irreversible.

Learn why faster payments require faster fraud-fighting tools. Watch this interview on PYMNTS.

The starting point for instant payment attacks is often through authorized push payment (APP) fraud. In other words, when the customer themselves initiates the payment, after being tricked or manipulated by the fraudster. Consequently, these fraud instances are much harder for FIs to pick up on. In the UK for instance, 97% of APP scams occurred on the UK Faster Payment rails.

Entersekt’s Chief Product Officer, Pradheep Sampath, summarizes the downside of this technology eloquently, “It’s absolutely clear that fraudsters see this faster instant payment methodology, where the money is immutable, as the primary attack vector to socially engineer people into parting with their hard-earned money.”

Biometric authentication enables modern, secure banking and payments

With such high stakes, banks and credit unions need controls that can differentiate customers from financial criminals in real-time. And provide immediate step-up authentication if there are red flags in the transaction. By adopting a proactive approach, leading FIs can stop this type of fraud before it happens and get the upper hand on the new types of fraud as they evolve.

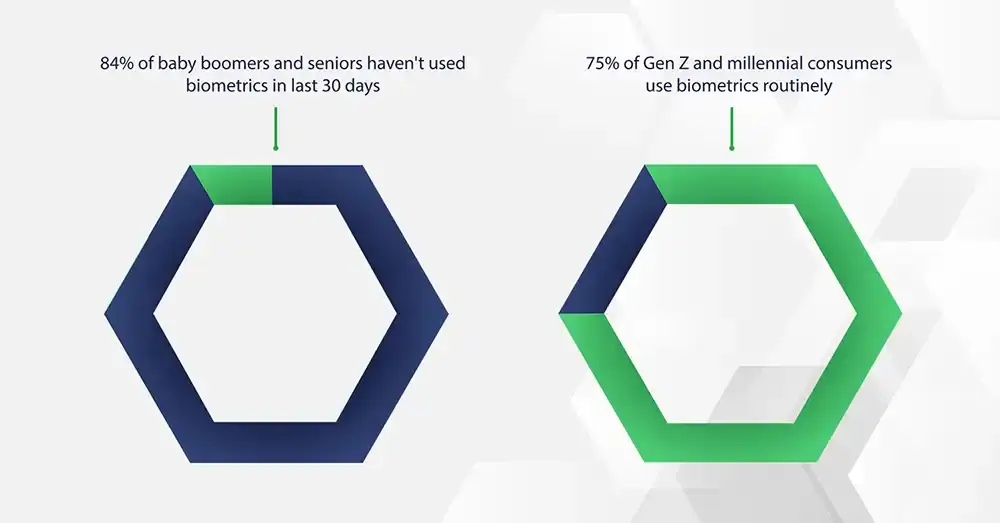

Biometric authentication provides a secure way for customers to verify their identity, in a way that doesn’t disrupt their transactions.

A recent PYMNTS study revealed that “...out of 60% of consumers who completed online purchases, 51% used biometric authentication to validate their transactions, eliminating the need to remember passwords or enter credit card information.” In that line, American Express recently added facial and fingerprint biometric measures to SafeKey, their fraud prevention service, to better align with modern consumer needs.

Biometrics play an essential role in instant payments as the authentication measure can confirm, undoubtedly, that it’s the actual customer making the transaction. To take safeguarding customers’ data a step further, FIs should include biometrics as a component of a cross-channel solution — one that covers all of a bank’s digital channels. That way, the system builds a picture of a customer’s intent behind each transaction. To gain this detailed level of context, data points must be shared across the channels to truly understand the customer’s behavior, and immediately differentiate friend from foe.

Other benefits of biometrics include the seamless user experience it provides for consumers, plus the added personalization when customers can choose how they want to verify their identity. By giving banking customers more control and freedom, FIs earn more trust and revenue in return.

Working together to prevent digital payment fraud

While biometrics help FIs keep pace with banking innovation and deliver great UX, securely, industry collaboration is another key to beating instant payment fraud. Here’s what BAI expressed regarding the importance of collaboration:

“The nationwide network of financial institutions will benefit tremendously if fraud professionals engage and share what they witness and learn. A collaborative approach that tracks and analyzes everything—from macro-level trends to micro details—will enable the larger fraud community to more quickly synthesize, report and act on emerging schemes. This, in turn, could allow the broader adoption of FedNow to occur with greater confidence and fewer risks.”