Many consumers are already familiar with biometric face scans, or selfies, to verify their identities for non-financial transactions. Apple users, for instance, use Face ID every day to unlock their newer-model iPhones.

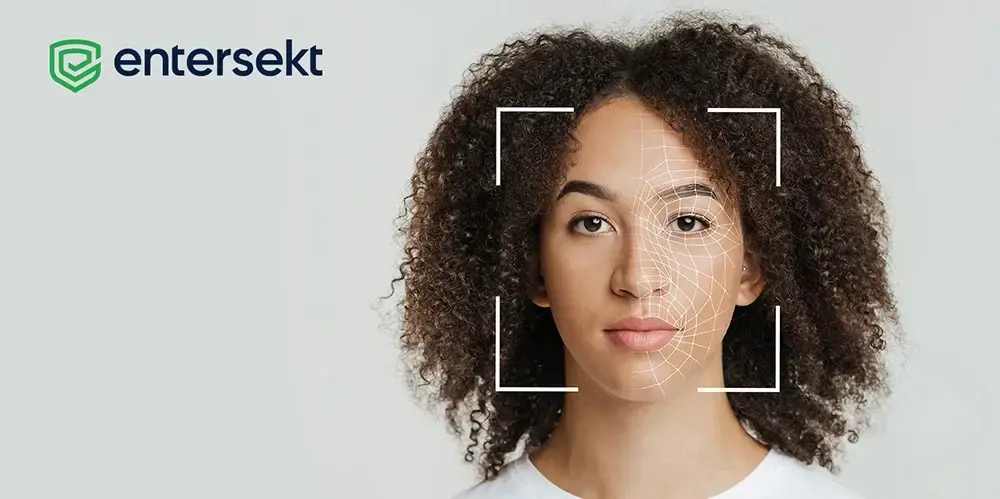

Selfie authentication – also known as facial biometric authentication or facial recognition – for digital banking works quite the same. Customers take a selfie with their mobile phone during the onboarding process, and that image is then used as a reference point to confirm their identities during subsequent logins and transaction approvals.

But, for various reasons, many financial institutions (FIs) are still wary of this type of technology, which, behind the scenes, compares specific facial features from the photo on file, like the distance between the eyes, ears, and nose, to the scan presented by the customer in real-time.

Considering that in 2021, 15 million Americans had their identities stolen resulting in losses of $52 billion, it's clear that FIs need to weigh up the pros and cons of this otherwise infallible way of obtaining real-time, digital customer verification.

Biometric face scans: Privacy and bias concerns

According to American Banker, “The overriding fear about banks' use of facial recognition is that it could result in people getting cut off from normal access to banking services. They might be denied loans or other services or charged higher rates because of, say, the color of their skin or their sex.”

Thus, there have been several calls for FIs to abandon biometric face scans for identity verification to avoid concerns around data privacy, AI biases, usability, accessibility, and the risk of facial spoofing. Which, perhaps, is understandable.

The reality, however, is that alongside advances in mobile/device technology, facial biometric authentication technology has become increasingly user-friendly over time, negating the aforementioned “usability” concern. Modern facial biometric authentication from the right provider can also dismiss the remaining concerns, helping financial institutions distinguish a customer from a fraudster — in a quick, intuitive way that doesn’t infringe on customers' privacy or disrupt their banking and payment journeys.

Turning to consumers themselves, report findings show that 76% of millennials are actually ‘very satisfied’ with selfie authentication. In fact, the top three reasons given were:

- Firstly, ‘it was easy to do’.

- Secondly, ‘it increased the level of trust with the service provider’.

- And thirdly, ‘I liked it more than using a password’.

Face scan identity verification from Entersekt

When considering the pros and cons, the overriding argument is that facial biometrics still provide a far greater customer experience and protection from digital banking fraud than legacy security measures, such as one-time passwords. They're also proven to be up to 99% accurate in most cases, which translates into significant reductions in false positives.

And, while we can only hope that banks' algorithms correct any biases over time, Entersekt’s face scan identity verification technology certainly helps turn all other cons into pros.

Convenience meets quality: Digital customer identification means customers don’t need to physically go to their nearest branch to add a new device or prove account ownership. Furthermore, the added automation frees up time and reduces operational costs, while adding an extra layer of cutting-edge security. Real-time selfie guidance ensures that images are of high enough quality to use for future verification requirements.

Impersonation concerns: Entersekt’s solution leverages AI liveness and verification tools to confirm a customer’s identity when adding a new device, recovering an account, or conducting sensitive transactions. Liveness detection is a type of facial scan technology that compares a verified ID photo of a customer on an FI’s database with a series of live ‘selfie’ shots the customer takes on their mobile phone. The technology verifies the customer’s identity and proves they are actually present, blocking any spoofing attempts.

Data privacy: Our solution adheres to strict data privacy regulations set out to protect the information and data of customers.

Impersonation concerns: Entersekt’s solution leverages AI liveness and verification tools to confirm a customer’s identity when adding a new device, recovering an account, or conducting sensitive transactions. Liveness detection is a type of facial scan technology that compares a verified ID photo of a customer on an FI’s database with a series of live ‘selfie’ shots the customer takes on their mobile phone. The technology verifies the customer’s identity and proves they are actually present, blocking any spoofing attempts.

Data privacy: Our solution adheres to strict data privacy regulations set out to protect the information and data of customers.

As fraudsters continue to leapfrog towards more complex schemes, time-consuming, in-person identity checks are no longer an option. By adopting innovative verification measures, like facial biometrics for digital customer identification, FIs can add an extra layer of security for high-risk or sensitive transactions, without adding extra friction.

Discover more benefits for your FI in our latest fact sheet: Identity Verification: Face Scans.