Consumers are at the mercy of scammers. And financial institutions (FIs) know it. According to the Datos Insights report, 'Fraud Landscape - Attack Trends and Defensive Strategies,' 65% of banks indicate card-not-present (CNP) fraud as the most common attack today. The report also warns that social engineering payment scams increased by 59% in 2024.

Issuers and processors need new ways to protect consumers from evolving scams. That definitely means updating security measures, such as one-time passcodes (OTPs) — which have been around since the 80s!

Issuers and processors need new ways to protect consumers from evolving scams. That definitely means updating security measures, such as one-time passcodes (OTPs) — which have been around since the 80s!

The ever-changing digital payment fraud landscape

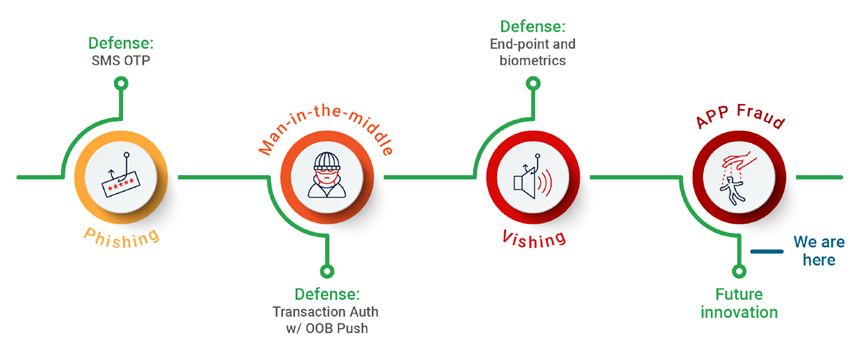

Fraud attacks have evolved over the years, each time to overcome a new fraud defense. For instance, phishing attempts were originally thwarted by OTPs. Then fraudsters found a way around that technology. Today, they have access to advanced artificial intelligence (AI) tools, like generative AI, to create scarily convincing scams that trick even tech savvy consumers. Many FIs are weary of how the latest and future iterations of attacks will play out.

“The US is the most fraud-prone country with 34% of consumers saying they were most likely to have been victims of fraud, with that percentage likely to be higher today.” — Mastercard

More flexibility and control with a modern 3DS ACS strategy

An outdated, rigid 3-D Secure ACS program can create frustrating control limitations for issuers. For instance, if they want to update branding elements or modify authentication logic in their ACS, these updates can be slow and expensive. Traditional ACS providers may take days or even weeks to process requests, with each change adding new fees and resource demands.

Modern ACS platforms take a different approach. They empower issuers with real-time control — allowing them to make updates independently, without waiting on a vendor or triggering additional costs. The technology should enable flexible and fast changes. Basically, providing FIs with more control over their ACS functionality and behavior.

Testing is another area where outdated systems can fall short. Many providers rely on limited or outdated data sets, making it hard to validate rule changes effectively. An advanced ACS like Entersekt’s gives issuers access to live, context-aware data. It also includes tools like a rule simulator, so teams can test and optimize safely before pushing updates to production. The result? Better rules, fewer changes, and smarter fraud prevention.

Modern ACS platforms take a different approach. They empower issuers with real-time control — allowing them to make updates independently, without waiting on a vendor or triggering additional costs. The technology should enable flexible and fast changes. Basically, providing FIs with more control over their ACS functionality and behavior.

Testing is another area where outdated systems can fall short. Many providers rely on limited or outdated data sets, making it hard to validate rule changes effectively. An advanced ACS like Entersekt’s gives issuers access to live, context-aware data. It also includes tools like a rule simulator, so teams can test and optimize safely before pushing updates to production. The result? Better rules, fewer changes, and smarter fraud prevention.

What to look for in a 3DS ACS provider

For issuers and processors that want to better protect their customers without hindering their experience, ensure your chosen 3DS ACS provider covers these key requirements:

- Modern authentication methods: including active and silent methods, like biometrics, protect customers from fraud threats without being disruptive.

- Silent authentication using cryptographic keys: more reliable and secure than OTPs while providing a frictionless experience for customers if the risk score is low.

- Cross-channel authentication: delivering holistic fraud prevention whichever channel a customer chooses.

- Flexibility: enabling FIs to adapt their ACS settings to meet their unique business and regulatory needs.

- Up-to-date compliance: proactively anticipating regulatory and technological changes.

Ultimately, an issuer’s or processor’s ACS needs access to data about each customer to assess the risk accurately and decide whether the transaction fulfils the criteria for a pass, risk, or challenge decision.

Entersekt 3-D Secure ACS: Enabling intelligent friction and seamless issuer control

At Entersekt, we want to bring the issuer closer to their ACS through integrated authentication methods, adaptive risk decisioning, and real-time compliance tools.

Something that the majority of ACS providers are lacking is the usability and configurability we mentioned earlier. Entersekt’s platform offers:

Something that the majority of ACS providers are lacking is the usability and configurability we mentioned earlier. Entersekt’s platform offers:

- A user-friendly portal

- Self-serve configuration

- Seamless integration with issuer-preferred risk engines

- Support for multi-tenant hierarchies

- End-to-end EMVCo-certified testing

- 24/7 global support

We want to support issuers and processors with a 3DS solution that serves their needs now and in the future. A solution that suits their business so they can optimize performance, reduce fraud, and enhance the cardholder experience.

But don’t just take our word. PYMNTS recently warned FIs of the urgent need “to implement dynamic defenses, including advanced analytics and behavioral monitoring, to stay ahead of these evolving [fraud] threats. Such proactive measures are critical not only for protecting customers’ finances but also for safeguarding consumer trust and confidence in the broader financial system, which scammers actively undermine.”

But don’t just take our word. PYMNTS recently warned FIs of the urgent need “to implement dynamic defenses, including advanced analytics and behavioral monitoring, to stay ahead of these evolving [fraud] threats. Such proactive measures are critical not only for protecting customers’ finances but also for safeguarding consumer trust and confidence in the broader financial system, which scammers actively undermine.”

Help choosing the right ACS provider

Selecting the right ACS provider isn’t just about technology — it’s a strategic move that can significantly reduce fraud, streamline operations, and strengthen customer trust.

Compare our ACS to others on the market and choose an ACS that matches your current — and future needs. Download our comprehensive 3DS ACS Buyer’s Guide today!

Compare our ACS to others on the market and choose an ACS that matches your current — and future needs. Download our comprehensive 3DS ACS Buyer’s Guide today!