Browser ID is the ultimate solution for financial institutions (FIs) aiming to decrease friction and increase security for both banking and payment authentication. Turn your customers' browsers into a secure possession factor with improved technology that addresses privacy concerns, and help your FI lower or even remove friction in use cases like banking logins, high-risk transactions, multi-factor authentication (MFA) situations like Strong Customer Authentication (SCA) and Secure Payment Confirmation (SPC) and even 3-D Secure authentication.

Browser ID is a form of silent attestation that uses a cryptographic keypair to identify and trust a user’s browser for authentication purposes in future transactions. Basically, it turns a browser into a possession factor, so customers provide additional proof that it’s them transacting, without having to do anything themselves.

With numerous items on an FI’s technology priority list, let's look at six ways Browser ID positively impacts FIs and their customers:

Browser ID is a form of silent attestation that uses a cryptographic keypair to identify and trust a user’s browser for authentication purposes in future transactions. Basically, it turns a browser into a possession factor, so customers provide additional proof that it’s them transacting, without having to do anything themselves.

With numerous items on an FI’s technology priority list, let's look at six ways Browser ID positively impacts FIs and their customers:

- Better UX with silent authentication

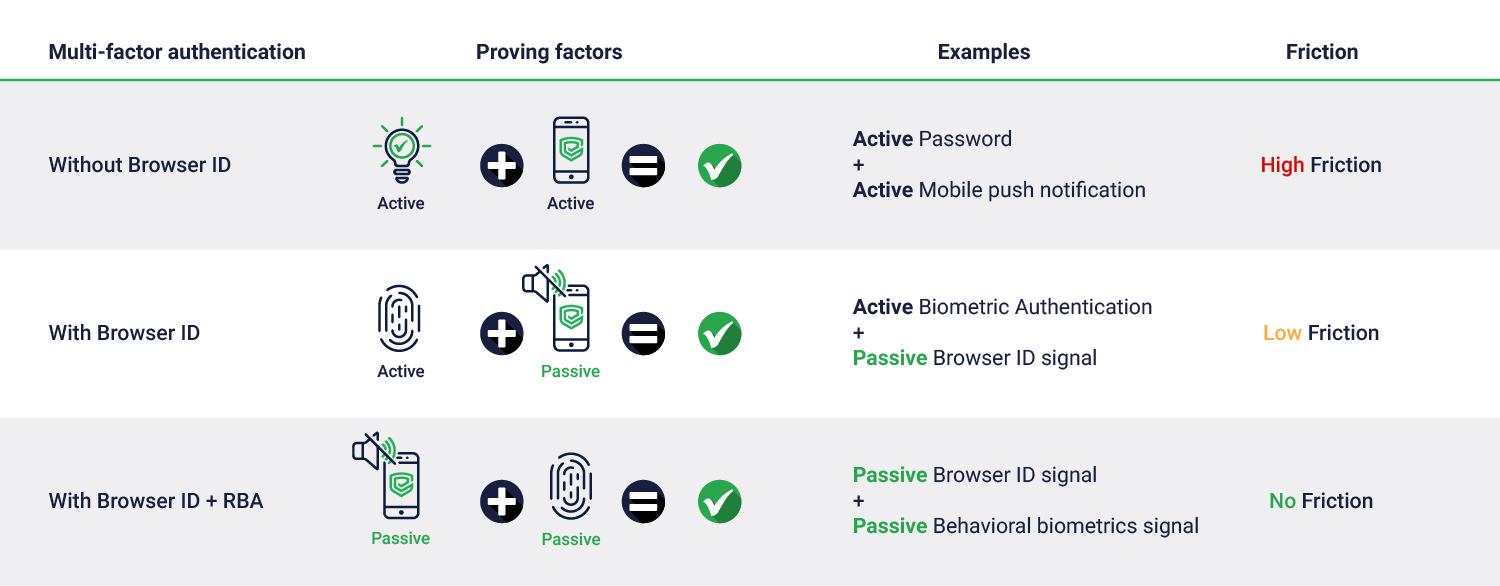

Bad user experiences lead to frustrated customers. The more hoops a user has to jump through, the worse the experience is. But FIs are doing themselves and their customers a disservice if they compromise security. What’s more, in many regions FIs must comply with regulations for multi-factor authentication like Strong Customer Authentication, as required in the Second Payment Services Directive (PSD2). However, not all your factors have to be active — swap out active possession factors with silent Browser ID to minimize friction and increase user satisfaction.

2. Increased payment security and transaction success rates

Issuers are always trying to balance the ease-of-use for cardholders so they can retain top-of-wallet status, versus the importance of strong authentication to reduce fraud and chargebacks. One-time passcodes (OTPs) and other active authentication methods don’t always work, can be clunky and can cause the cardholder to abandon checkout, to use another card or to give up on the transaction entirely. Browser ID provides a reliable, silent layer of authentication, removing friction from the checkout process, reducing payment fraud and increasing transaction success rates.

3. Seamless login experiences that don't rely on passwords

Passwords are frequently forgotten, and OTPs are easily intercepted. Entersekt's Browser ID enables users to register their browsers as “trusted” on their profiles. That way any future logins can be performed silently and frictionlessly by matching the Browser ID to the account, enabling a seamless login experience free of passwords or any additional steps.

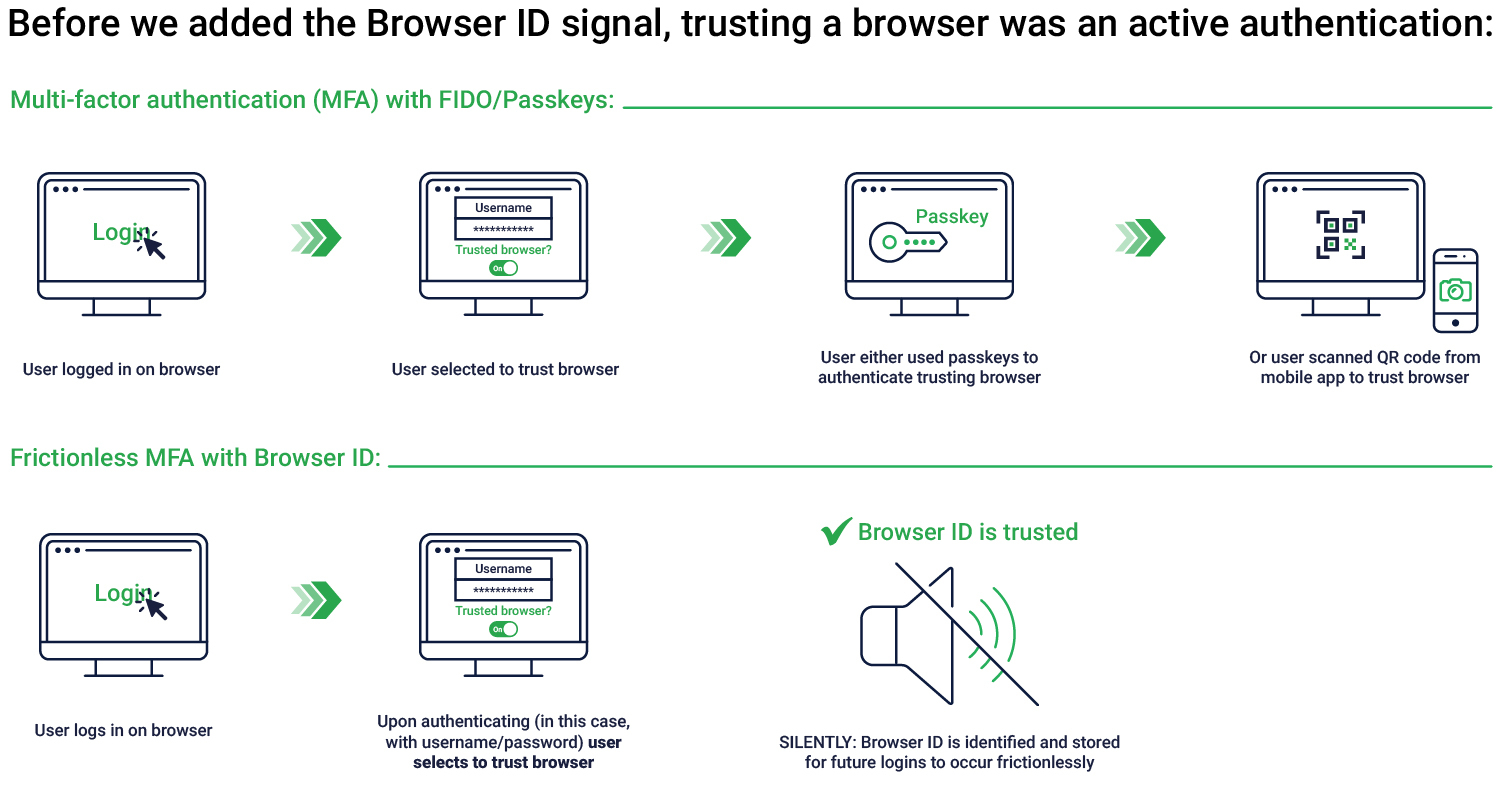

4. Frictionless multi-factor authentication (MFA)

Fraud is not slowing down, and neither should your security measures. Entersekt's Browser ID used in conjunction with Behavioral Biometric signals enables frictionless MFA for banking and payment authentication journeys, fighting fraud while optimizing the user experience.

5. Privacy concerns, eliminated

Privacy concerns have become top of mind for regulators and consumers. And with regulations catching up, using cookies and other outdated technology could have a negative impact for FIs. Entersekt's Browser ID authenticates safely and silently without tracking a user across any additional actions, behaviors, or domains.

6. Regulatory compliance, checked

Browser ID enables FIs to adhere to regulatory compliance standards such as SCA and SPC where required, like in European regions governed by the Second Payment Services Directive (PSD2), PSD3 or the Payment Services Regulation (PSR1) regulations, without unnecessarily increasing friction.

Where does Browser ID best fit into the authentication process?

For frictionless digital banking login: Trust your browser with Browser ID and allow frictionless login for subsequent logins on the same browser.

What is the role of Browser ID in Strong Customer Authentication (SCA)?

SCA requires authentication solutions to use at least two of the following three factors: Inherence, possession, and knowledge.

During a high-risk transaction requiring SCA or a multi-factor authentication session, Browser ID, a silent, frictionless authenticator, proves the possession factor, alongside an active authenticator to prove the inherence factor. During this flow, only one of the attestations is active, but two factors are being proven, making it multi-factor but not multi-actioned.

To eliminate all friction during multi-factor authentication, Browser ID can be used as a silent possession factor and behavioral biometric signals as a silent inherence factor. In this case, both attestations are silent, therefore frictionless while providing the same level of security.

During a high-risk transaction requiring SCA or a multi-factor authentication session, Browser ID, a silent, frictionless authenticator, proves the possession factor, alongside an active authenticator to prove the inherence factor. During this flow, only one of the attestations is active, but two factors are being proven, making it multi-factor but not multi-actioned.

To eliminate all friction during multi-factor authentication, Browser ID can be used as a silent possession factor and behavioral biometric signals as a silent inherence factor. In this case, both attestations are silent, therefore frictionless while providing the same level of security.

How does Browser ID benefit 3-D Secure transactions?

EMV 3-D Secure 2.0 is the main payment card protocol for authenticating online payments and meeting SCA requirements. Much like with SCA, Browser ID supplies the silent possession factor for 3-D Secure payment authentication sessions, alongside an active authenticator like biometrics, providing an additional way to uniquely identify customers. These use cases can authenticate multiple factors with low or even no friction.

Here's how:

Here's how:

Entersekt’s new Browser Authentication feature is a big step into the frictionless future, where increasing security does not have to result in frustrating customer experiences.

If you’d like to explore how our innovative Browser Authentication solution can protect your FI from phishing, man-in-the-middle attacks and payment card fraud, without adding unnecessary friction, you can learn more here.