In 2022 alone, the number of online shoppers in Europe was forecast to reach over half a billion people. Thanks to the advances in digital banking and authentication technology, these consumers can now shop safely and conveniently wherever they are and on whichever device they choose.

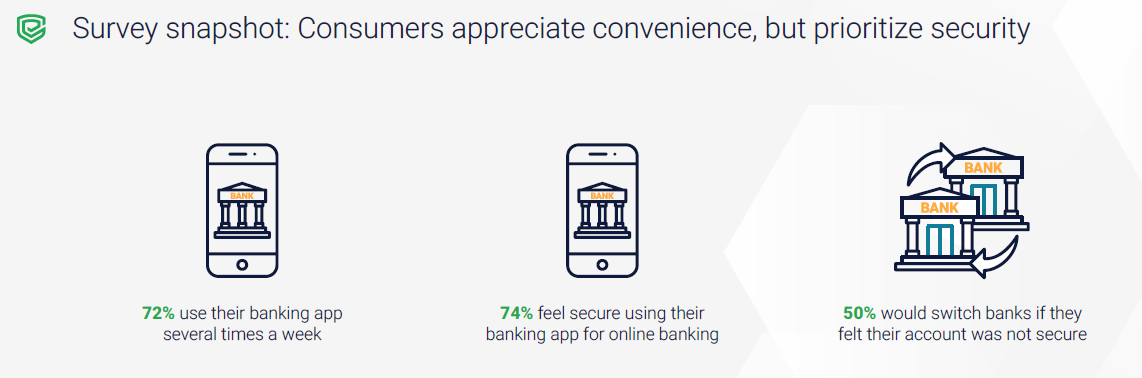

That being said, it should be noted that they have their own ideas about the security versus convenience of their transactions. In our recent consumer survey report: Fighting back against mobile banking and payments fraud in Europe, we share valuable insights that can help financial institutions better understand these needs — ultimately helping to improve customer loyalty, retain and grow their customer base, and boost revenue generation.

Surprising digital payments preferences for mobile banking customers

We recently partnered with global market research consultancy, Censuswide, to conduct a survey of 5,000 mobile banking users across the UK, Norway, Hungary, and Germany. The report revealed interesting insights into the evolution of banking and payment security in , and the expectations of today’s banking customers.

Here are a few:

Furthermore:

- 51% are worried about fraud when shopping online.

- 51% would hold their banks responsible for any fraud or cybercrime.

- 71% prioritize the security of a transaction over the user experience.

And, while the debate of security versus convenience is ongoing around the globe, these report findings suggest that in Europe, many consumers appreciate modern technological convenience, but expect that their data will be safe at all times.

It has long been the assumption that banking customers would prefer frictionless transactions. However, the research does not back this up. Given a choice, some customers would actually prefer to authenticate their transactions.

Core mobile banking and online payments security highlights

The report findings indicate a distinct shift towards more modern payment solutions, such as biometrics and open banking. Yet, we still noted a preference, in places, for outdated authentication methods, like SMS OTP.

Fortunately, many consumers have a greater awareness of regulatory requirements, like Strong Customer Authentication (SCA), resulting in them prioritizing the security of online payments over the level of friction of their transactions.

Other highlights from the report include:

- The need to prioritize mobile banking solutions if FIs want to retain and grow their customer base.

- Since convenience does rank high, banks should employ modern banking and customer authentication solutions that don’t interrupt customer transactions.

- To increase trust, FIs should still emphasize the security of their digital banking solutions.

- Consumers feel more comfortable with visible security for infrequent or higher-risk transactions.

When consumers are banking and shopping online, the user experience should leave them feeling confident in their bank’s security. And eager to not only support, but also champion their bank or credit union.

Download the full report to learn more about current consumer sentiment on mobile banking and payment security in Europe.