The mobile-first foundation of digital transformation

While Sub-Saharan Africa still has a long way to go to reach the level of digital connectedness seen in developed economies, significant strides have been made over the last few years.

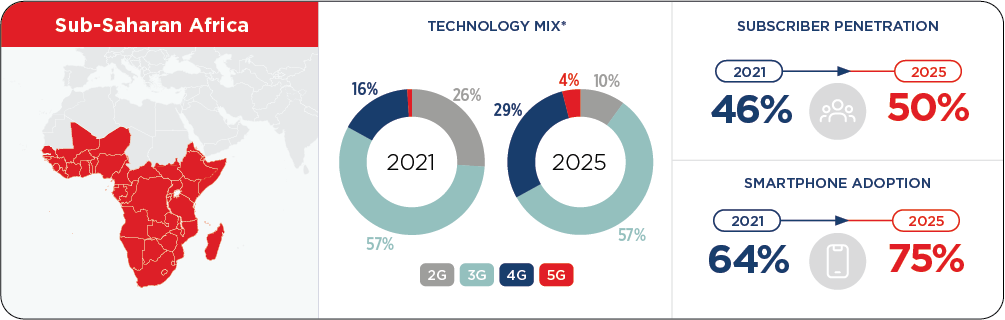

In its 2022 edition of The Mobile Economy report, the GSMA reports that the mobile industry in Sub-Saharan Africa has risen to the challenge of keeping individuals and businesses connected during the pandemic, and that growth will continue over the next few years. The association predicts that smartphone adoption in the region will increase from 64% in 2021 to 75% in 2025.

“Smartphone adoption in the region will increase from 64% in 2021 to 75% in 2025.”

Growth in smartphone and mobile internet penetration sends a positive signal to investors looking at the opportunity presented by digital transformation in Africa. Technology is a key driver of economic growth in the region, and the mobile industry is viewed as strategically important in achieving the UN’s Sustainable Development Goals.

The speed at which African financial services institutions can accelerate their digital transformation will largely depend on access to the internet, customers who prefer digital engagement, and the use of electronic devices. The rise in mobile and internet penetration offers opportunities for financial institutions to reach potential customers and provide digital services to them through channels such as USSD, SMS, and mobile apps.

Mobile money and e-commerce drive innovation in financial services

With its reputation as a mobile-first continent, it should come as no surprise that Africa is also a vibrant hub for innovation in mobile financial services.

Mobile money technology that allows people to receive, store, and spend money using their mobile phones has thrived more in Africa than on any other continent. Mobile money has played a substantial role in financial inclusion, serving a significant proportion of previously unbanked consumers. It has also been a game-changer in African markets that do not have satisfactory branch networks.

“Africa has the second-fastest-growing banking market in the world.”

In terms of more traditional financial services, a recent McKinsey report indicates that Africa has the second-fastest-growing banking market in the world. Such an increase means that the opportunities presented by digital transformation in financial services are now more prevalent than ever before.

During the pandemic, e-commerce has experienced phenomenal growth rates around the world. While Sub-Saharan Africa is still considered one of the smallest e-commerce markets in the world, steady growth in the region signals potential. A new e-commerce report by Visa states that e-commerce has seen a 42% year-on-year growth in the region from 2019 to 2020. Card-not-present transactions in particular are gaining traction in the region.

“e-Commerce has seen a 42% year-on-year growth in the region from 2019 to 2020.”

The increase in smartphone penetration, the success of mobile money and the boom in e-commerce are all factors that combine to create a comfortable launchpad for success in digital transformation in financial services across Sub-Saharan Africa.

The potential bump in the road to digital transformation success

While digital transformation is an exciting development for the continent, it also has exposed the risk that comes with growth. With an increase in transactions and interactions being channeled towards digital banking platforms, fraudsters are gearing up to act at scale.

As much as consumers stand to benefit from the uptick in digital activity, so too will cybercriminals use the chance to pounce at unsuspecting consumers, particularly novices in digital technology.

Fortunately, cyber-attacks can be mitigated by partnering with organizations that can leverage machine learning and AI to help detect fraud. Cutting-edge technology will enable financial institutions to respond quickly to fraudulent activity and manage risk to ensure the safety of their customers.

Entersekt partnered with one of the world’s leading digital banks to offer their customers frictionless e-commerce checkouts with real-time risk-based authentication (RBA). Read more about how our integration with NuData Security has made this possible.